The Dow Jones Industrial Average (DJIA) tumbled as much as 1,500 points yesterday and closed down an astonishing 1,175 points – a 4.6 percent loss. The Standard & Poor’s 500 (S&P 500), a broader stock market index and generally better metric for measuring stock market performance, was also down by more than 4 percent. In percentage terms, these drops aren’t new records, but they’re certainly significant.

Does this presage an economic recession? What exactly, if anything, does the stock market tell us about economic performance? To answer this question, let’s compare the S&P 500’s annual returns to U.S. real GDP annual growth from 1930 to 2017. We’ll use a dataset of annual S&P 500 returns from NYU Stern School of Business and a dataset of the U.S. real GDP growth rates from the Federal Reserve Bank of St. Louis.

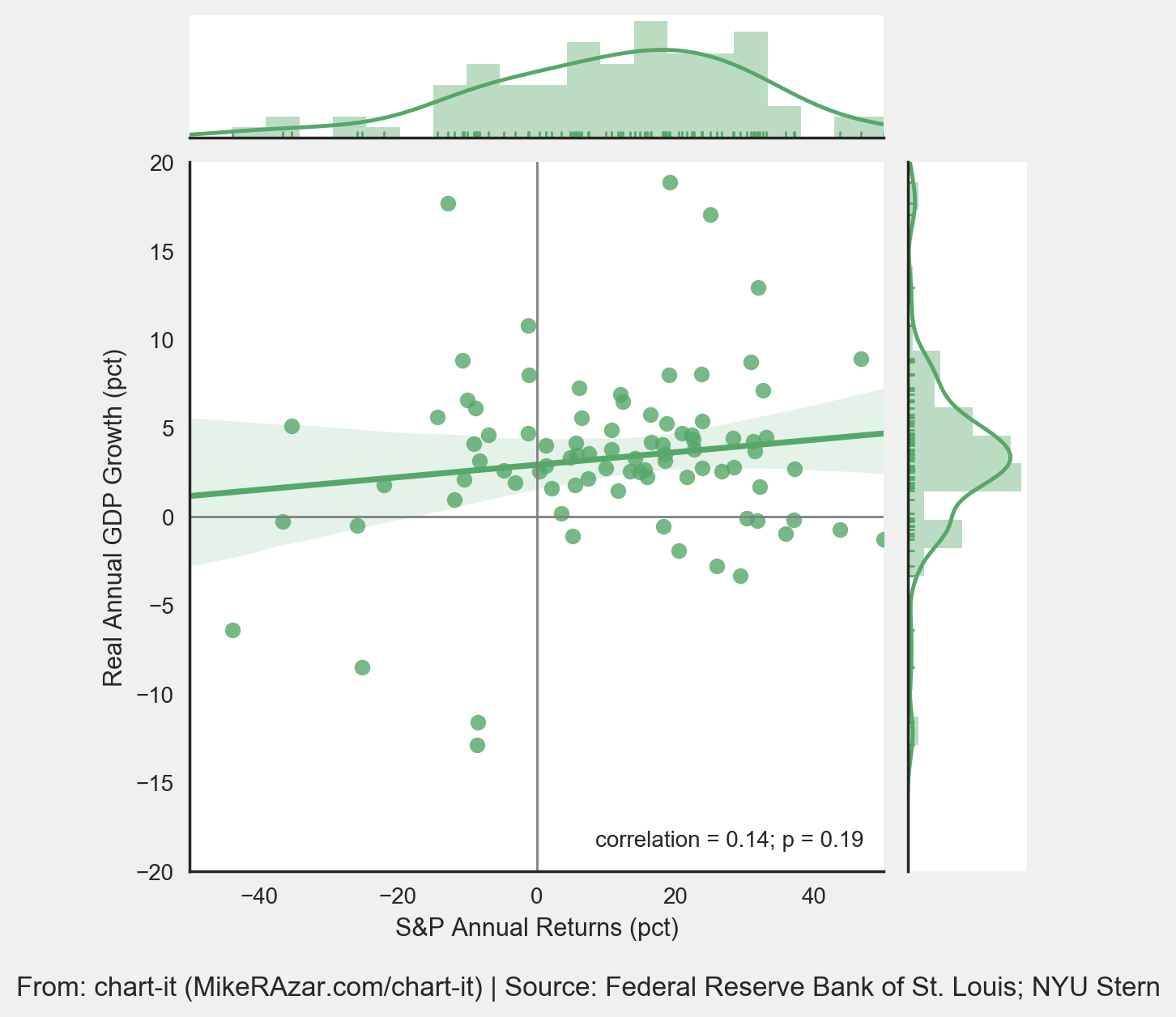

Figure 1 compares annual S&P 500 returns to annual U.S. real GDP growth (each dot represents one year). We’ve added a line of best fit and the 95% confidence interval around it. We’ve also plotted the distribution of S&P 500 returns and GDP growth rates. Visually, there does not appear to be a meaningful relationship between stock market returns and GDP growth but let’s see if we can make any statistical inferences from the data.

Figure 1. Annual S&P 500 Returns Vs. Annual Real GDP Growth

One way to quantify the relationship between stock market returns and GDP growth is by using the correlation coefficient. Correlation measures the strength of the relationship between two variables and has a value between -1 (i.e., the variables move exactly in opposite directions) and 1 (i.e., the variables move in the same direction). A value of zero suggests no relationship between the two variables.

As indicated in Figure 1, the correlation between S&P 500 returns and GDP growth is very weak (0.14). The p-value (0.19) suggests that the relationship is not statistically significant. We’re not able to demonstrate that a statistically significant relationship exists between S&P 500 returns and real GDP growth.

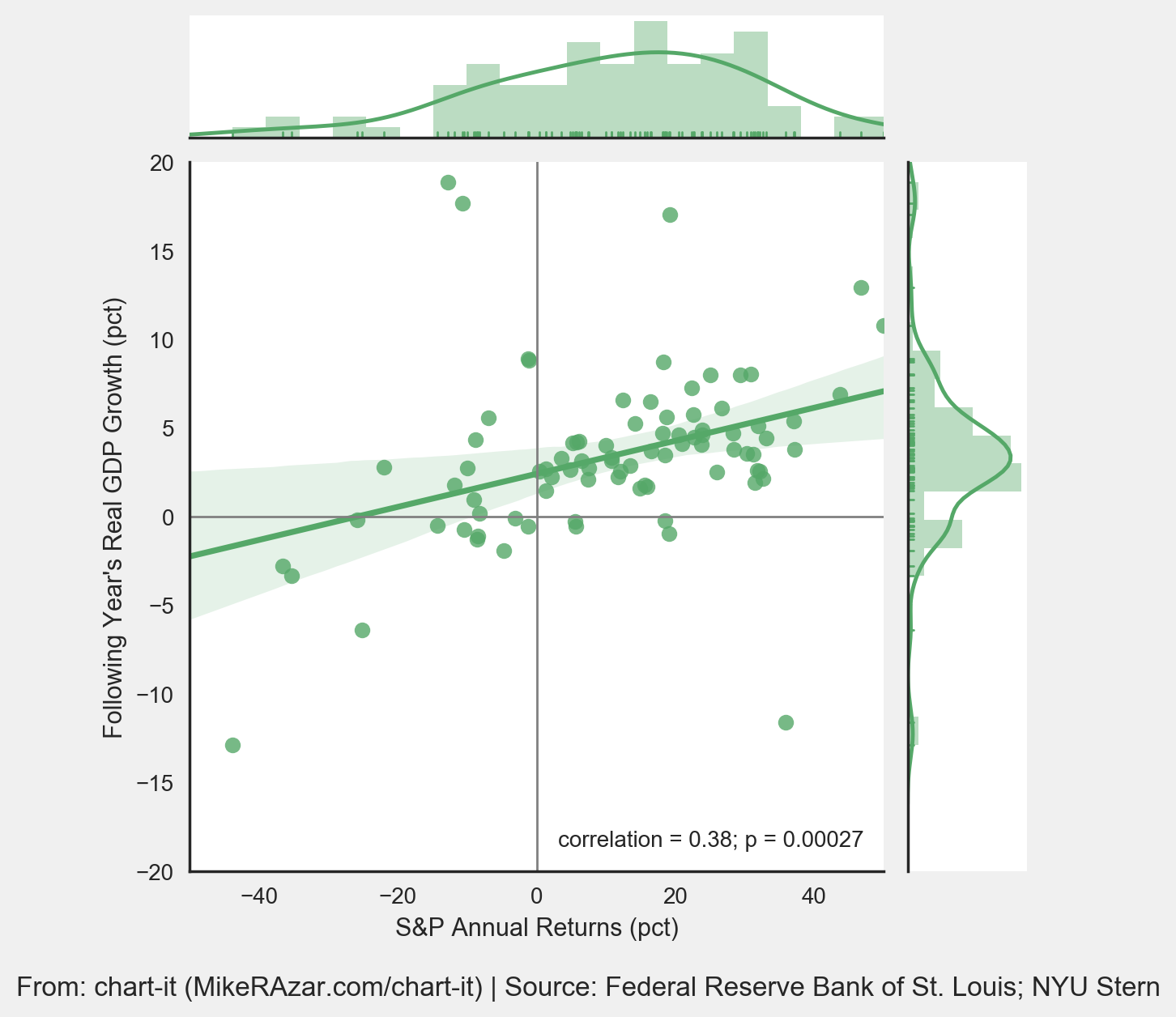

However, the stock market, with its daily trading and deep liquidity, might process and reflect economic information faster than the GDP growth rate. Perhaps, therefore, stock market performance in a given year might tell us something about GDP growth in the following year.

Figure 2 compares annual S&P 500 returns in one year to the next year’s real GDP growth rate.

Figure 2. Annual S&P 500 Returns Vs. Following Year’s Real GDP Growth

The correlation (0.38) is stronger than we observed in Figure 1, but it is still generally weak. A correlation coefficient less than 0.50 is considered to be a weak positive relationship. The p-value (<0.01) indicates that the relationship is statistically significant. As a result, we can say that there is a statistically significant relationship between S&P 500 returns in one year and GDP growth the following year, but the relationship is weak.

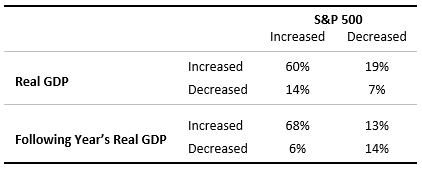

Another way to measure the relationship is to look at it on a binary basis. In other words, rather than measuring whether there is a linear relationship between how much the S&P 500 changes and how much real GDP changes, we can identify simply whether they tend to be positive or negative at the same time (saying nothing about the magnitude of such change). Figure 3 shows the percentage of years that the S&P 500 increased or decreased as compared to GDP growth.

One way to interpret this table is to say that 33 percent of the time (19% + 14%), the S&P 500 and GDP moved in opposite directions, or 19 percent of the time (13% + 6%) if we compare the S&P 500 in one year to GDP growth in the following year. The table also shows that they both increased together more than 60 percent of the time, but that is to be expected. After all, in the vast majority of years, the stock market goes up and GDP grows.

Figure 3. Percentage of Years that the S&P 500 and Real GDP Moved Together or Apart

The source code for this analysis can be found here.